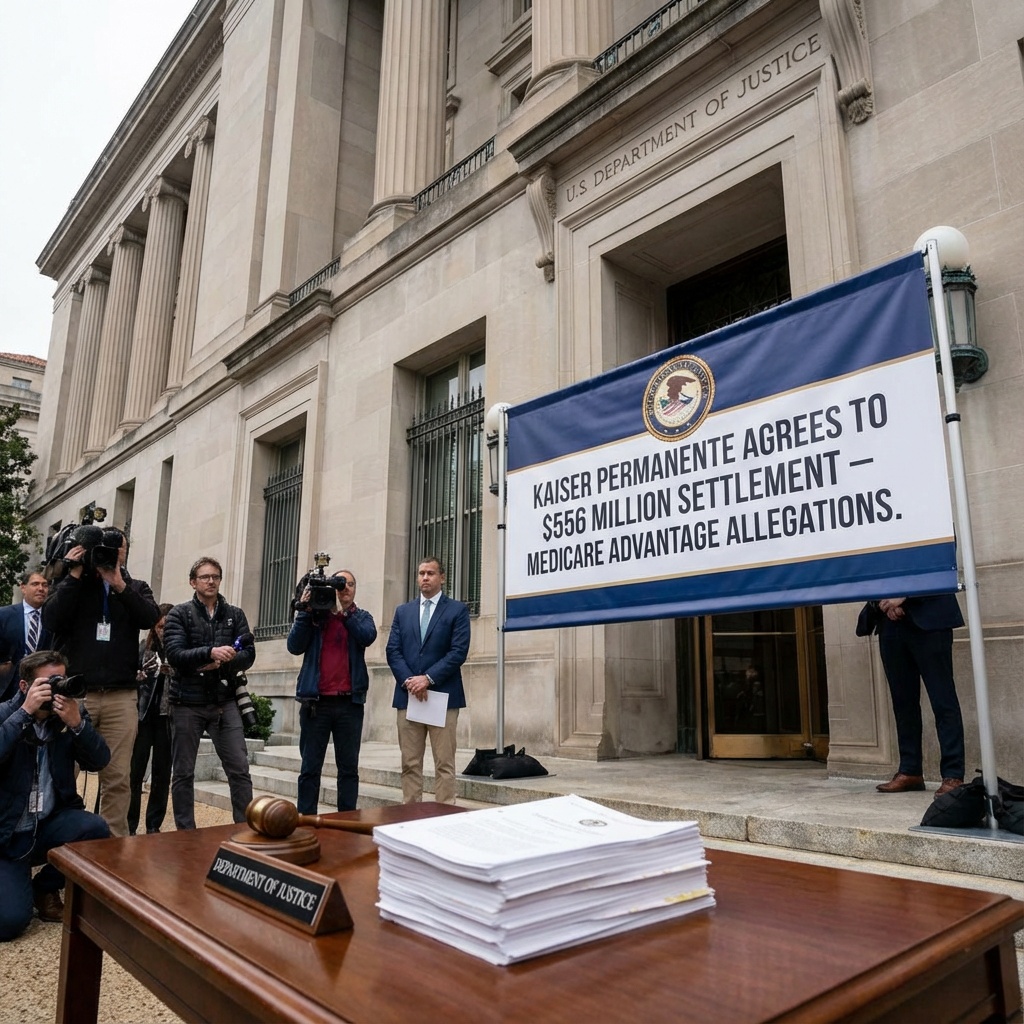

Kaiser Permanente to Pay $556M to Settle Medicare Advantage Fraud Allegations

The settlement marks one of the largest risk-adjustment settlements in recent history, underscoring ongoing federal scrutiny of Medicare Advantage programs. This case highlights the complexities and regulatory challenges facing healthcare organizations operating within government programs.

In a significant development within the healthcare regulatory landscape, Kaiser Permanente has agreed to pay $556 million to settle allegations brought forward by the U.S. Department of Justice. The allegations centered on claims that Kaiser Permanente affiliates improperly inflated payments from the Medicare Advantage program by submitting inaccurate diagnosis codes.

Medicare Advantage, a government-run program providing Medicare benefits through private insurers, incorporates risk-adjusted payments to compensate plans that manage sicker patients. Accurate coding of diagnoses plays a critical role in determining the funding these plans receive. According to the allegations, Kaiser Permanente’s affiliates engaged in practices that inaccurately elevated risk scores and thus unjustly increased payments.

This settlement is notably one of the largest risk-adjustment settlements related to Medicare Advantage to date. It exemplifies the continued vigilance and regulatory enforcement efforts targeting fraud, waste, and abuse within federal healthcare programs. The implications of this settlement extend beyond financial restitution; it sends a clear message about the importance of compliance and the need for rigorous oversight in coding practices within healthcare organizations.

The case underscores the complexity of Medicare Advantage payment methodologies and the critical role that diagnosis coding plays. Improper coding can distort not only financial flows but also impact data fidelity critical for population health management and policy decisions.

For healthcare organizations participating in Medicare Advantage and other government programs, this development reinforces the necessity of robust internal controls, compliance frameworks, and audit preparedness. It also reflects the intensifying scrutiny that federal agencies are dedicating to program integrity.

Overall, Kaiser Permanente’s settlement reflects the broader context of ongoing federal efforts to ensure accountability, transparency, and fairness in healthcare financing. The stakes remain high for healthcare providers and insurers managing government contracts as regulators maintain a focus on fraud prevention and program integrity enhancements.

The case serves as an important point of analysis for stakeholders monitoring risk adjustment, compliance risk, and regulatory enforcement as the healthcare landscape evolves.

For detailed information, see the original report here: Kaiser Permanente to Pay $556M to Settle Medicare Advantage Fraud Allegations.

Join the BioIntel newsletter

Get curated biotech intelligence across AI, industry, innovation, investment, medtech, and policy—delivered to your inbox.